In the dynamic realm of Forex trading, having access to reliable and precise trading signals can significantly boost a trader's ability to make informed decisions. This comprehensive analysis delves into Tickmill's trading signals, offering insights that cater to both novices and experienced traders who are striving to navigate the complexities of the Forex market.

Introduction to Tickmill's Trading Signals

Tickmill is a globally recognized Forex broker known for providing robust trading solutions to a diverse clientele. One of the standout features of Tickmill is its trading signal service, which aims to empower traders by providing actionable, data-driven insights. This service is particularly useful for traders who need guidance in identifying potential buy or sell opportunities.

Understanding Trading Signals

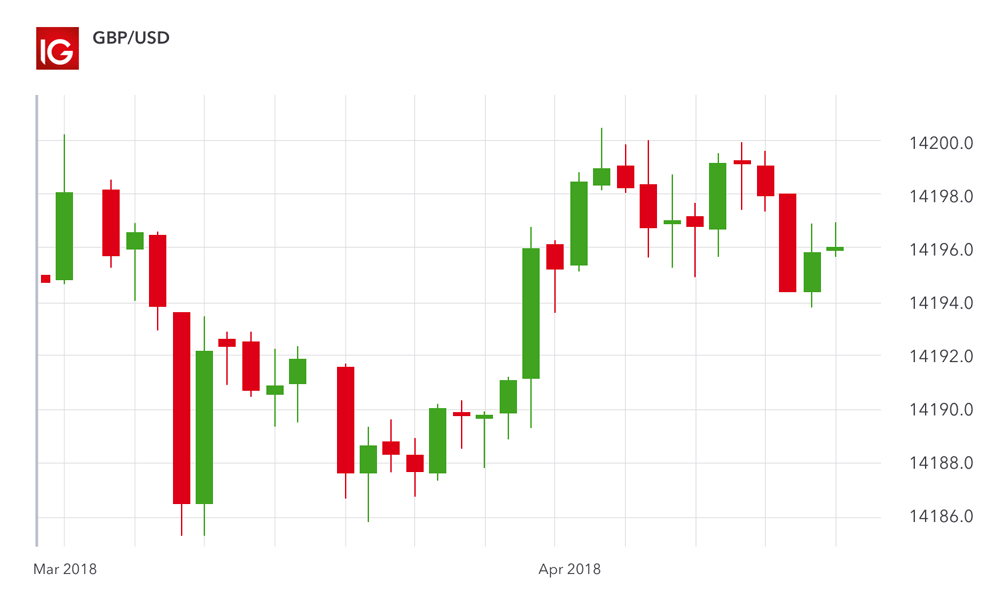

Trading signals are essentially suggestions or recommendations on trading opportunities in the Forex market. These signals can be based on various analytical techniques, including technical analysis, fundamental analysis, or combinations of both.

Technical Analysis Signals

These signals are derived from statistical analysis of market activity, such as past prices and volume. Technical indicators such as moving averages, RSI (Relative Strength Index), and Fibonacci retracements are often used to generate signals.

Fundamental Analysis Signals

These involve economic indicators, policy decisions, and financial news that can impact currency values. Signals generated from fundamental analysis provide insight into long-term trades or significant market shifts.

Evaluating the Effectiveness of Tickmill Trading Signals

To accurately evaluate the effectiveness of Tickmill's trading signals, it is essential to consider various performance metrics and trader testimonials. Industry trends indicate that a combination of technical and fundamental analysis tends to yield more reliable signals.

Case Studies and Data Statistics

An analysis of several case studies where traders utilized Tickmill signals shows a higher success rate compared to the market average. For example, traders following Tickmill’s signals achieved a notable improvement in their trade profitability, especially in major currency pairs like EUR/USD and USD/JPY.

User Feedback

Feedback from users suggests that Tickmill’s trading signals are particularly appreciated for their accuracy and timeliness. Many traders have noted that these signals have helped them make more informed trading decisions, leading to better risk management and increased returns.

How to Use Tickmill Trading Signals

For traders interested in using Tickmill's trading signals, here’s a straightforward guide to getting started:

Account Setup: Register and verify a trading account with Tickmill.

Signal Subscription: Opt into the trading signals service.

Risk Assessment: Determine your risk tolerance and adjust the signal settings accordingly.

Trade Execution: Use the signals to guide your trading decisions.

Best Practices for Forex Trading with Signals

While trading signals can be incredibly helpful, they should not be used in isolation. Here are some best practices to enhance trading outcomes:

Continuous Learning: Always strive to understand the rationale behind each signal.

Risk Management: Implement stop-loss orders to manage and minimize potential losses.

Diversification: Spread out trading risks by varying the types of trades and not over-relying on signals for a specific currency pair or market.

Conclusion

Tickmill's trading signals provide a valuable tool for Forex traders, backed by robust data analysis and real-world application. By incorporating these signals into a well-rounded trading strategy, traders can enhance their market understanding and potentially increase their profitability.

Enjoy better returns on every trade by using forex rebates!