The allure of forex signals lies in their promise to simplify the complex world of forex trading by providing actionable recommendations on currency trades. However, the question of whether one can truly be profitable with forex signals remains a hot topic among traders. This article, drawing from discussions and analyses on Traders Union, explores the potential profitability of forex signals, the factors that influence their success, and the strategies traders might consider for using them effectively.

Understanding Forex Signals

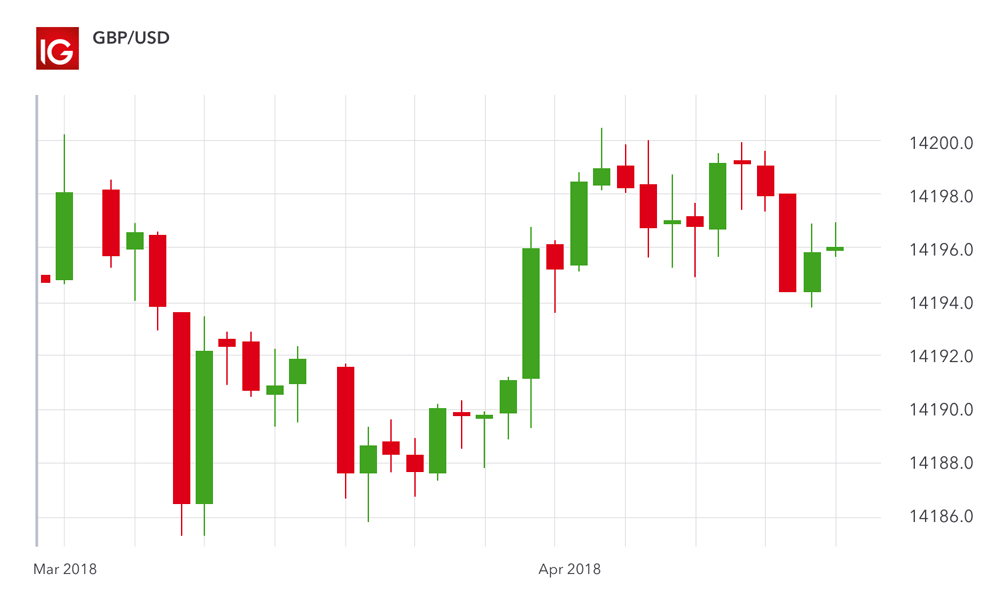

Forex signals are suggestions made by either experienced traders or sophisticated algorithms that aim to identify profitable trading opportunities. They typically include key trading parameters such as entry point, stop loss, and take profit levels. The use of forex signals is common among both new and seasoned traders as a means to make informed trading decisions.

The Profitability Debate

Traders Union forums are replete with debates about the profitability of forex signals. Success stories are often juxtaposed with tales of losses, painting a picture of a trading tool with mixed results. The key to understanding this disparity lies in several factors that can significantly influence the outcome of using forex signals.

Source of Signals: The origin of forex signals plays a crucial role in their reliability. Signals can be generated by automated systems based on technical indicators or by human traders based on their market analysis. Generally, signals from reputable and experienced analysts or well-programmed systems tend to have higher reliability.

Market Conditions: Forex markets are influenced by a myriad of factors including geopolitical events, economic indicators, and market sentiment. The effectiveness of forex signals often depends on the prevailing market conditions, with some signals performing better in volatile markets while others might be suited to more stable conditions.

Trader's Expertise: The trader's understanding of forex trading and their ability to implement signals effectively also impact profitability. Traders who are able to interpret additional market signals and combine them with their trading strategies generally achieve better results.

Factors Contributing to Success with Forex Signals

To potentially increase profitability when using forex signals, traders might consider the following strategies:

Comprehensive Research on Providers: Before subscribing to a signal service, traders should conduct thorough research on the provider. This includes looking at the track record, reviews from other traders, and the transparency of the signal service.

Risk Management: Implementing robust risk management strategies is critical. This involves setting appropriate stop-loss orders to protect capital and adjusting position sizes based on the confidence level of the signal and the market conditions.

Diversification: Using signals for multiple currency pairs and combining the signals with different trading strategies can spread risk and increase potential points of profit.

Continuous Education and Adaptation: Markets evolve, and so should trading strategies. Successful traders continuously educate themselves about market dynamics and adapt their use of forex signals accordingly.

Realistic Expectations and Monitoring

Traders should have realistic expectations when using forex signals. Not all signals will lead to profits, and the goal should be to achieve a positive return over time, rather than expecting every trade to be successful.

Additionally, monitoring the performance of forex signals is essential. Keeping a trading journal where all signal-based trades are recorded can help traders analyze which signals are working and under what conditions.

Conclusion

The discussions on Traders Union suggest that while it is possible to be profitable with forex signals, success is not guaranteed. Profitability depends on a variety of factors including the quality of the signals, the trader’s skill and implementation, and external market conditions. By choosing reliable signal providers, applying solid risk management techniques, and maintaining a disciplined approach to trading, traders can increase their chances of achieving profitability with forex signals. This comprehensive approach, combined with ongoing learning and adaptation, is essential for long-term success in forex trading.

Transform your trading experience using accurate free forex signals tailored to your needs!